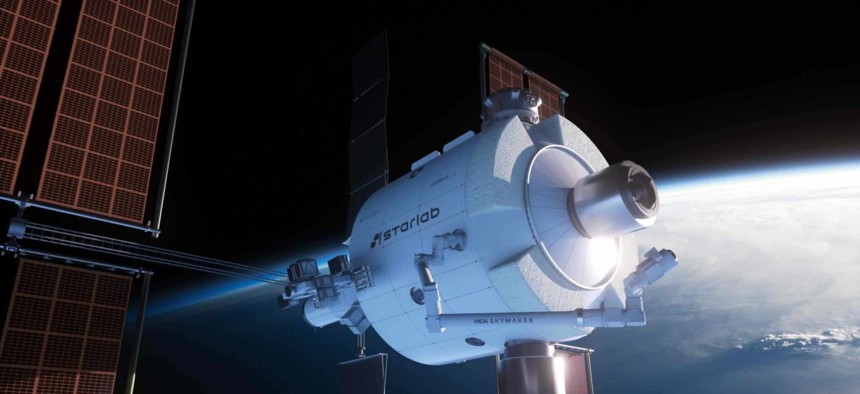

A digital rendering of Starlab. Courtesy of Starlab.

Voyager fetches $383M in public offering

Substantially all of the proceeds will go toward Starlab, which the six-year-old company is offering NASA as a replacement for the International Space Station.

Voyager Technologies has fetched roughly $383 million in an upsized initial public offering, where demand for stock in the defense and space systems maker ran hotter than originally anticipated.

In the company’s Wednesday debut on the New York Stock Exchange, Voyager sold 12.3 million shares at $31 each to exceed the original range of $26-to-$29 marketed to investors at first. Voyager originally planned to offer 11 million shares.

With those specs, Voyager secured a $3.8 billion valuation from the public markets to exceed its target of $1.6 billion.

The IPO’s underwriters also have a 30-day option to purchase up to 1.85 million additional shares, up from 1.65 million. Voyager’s stock is trading under the ticker symbol VOYG.

Voyager’s primary use for the IPO proceeds is to invest in Starlab, its concept for a commercial space station that the six-year-old company is offering NASA as a replacement for the International Space Station.

NASA is Voyager's largest customer at approximately one-fourth of the $144.2 million in revenue posted for 2024, while U.S. government work overall represented 84% of the sales mix.

Goldman Sachs, Bank of America Securities and J.P. Morgan are lead book-running managers. Barclays, Citigroup, Credit Suisse and Morgan Stanley are book-running managers. IMI-Intesa Sanpaolo, MUFG and UniCredit Capital Markets are co book-running managers.